Financial Intelligence

Be Prepared for a New Point in the

Interest Rate Cycle

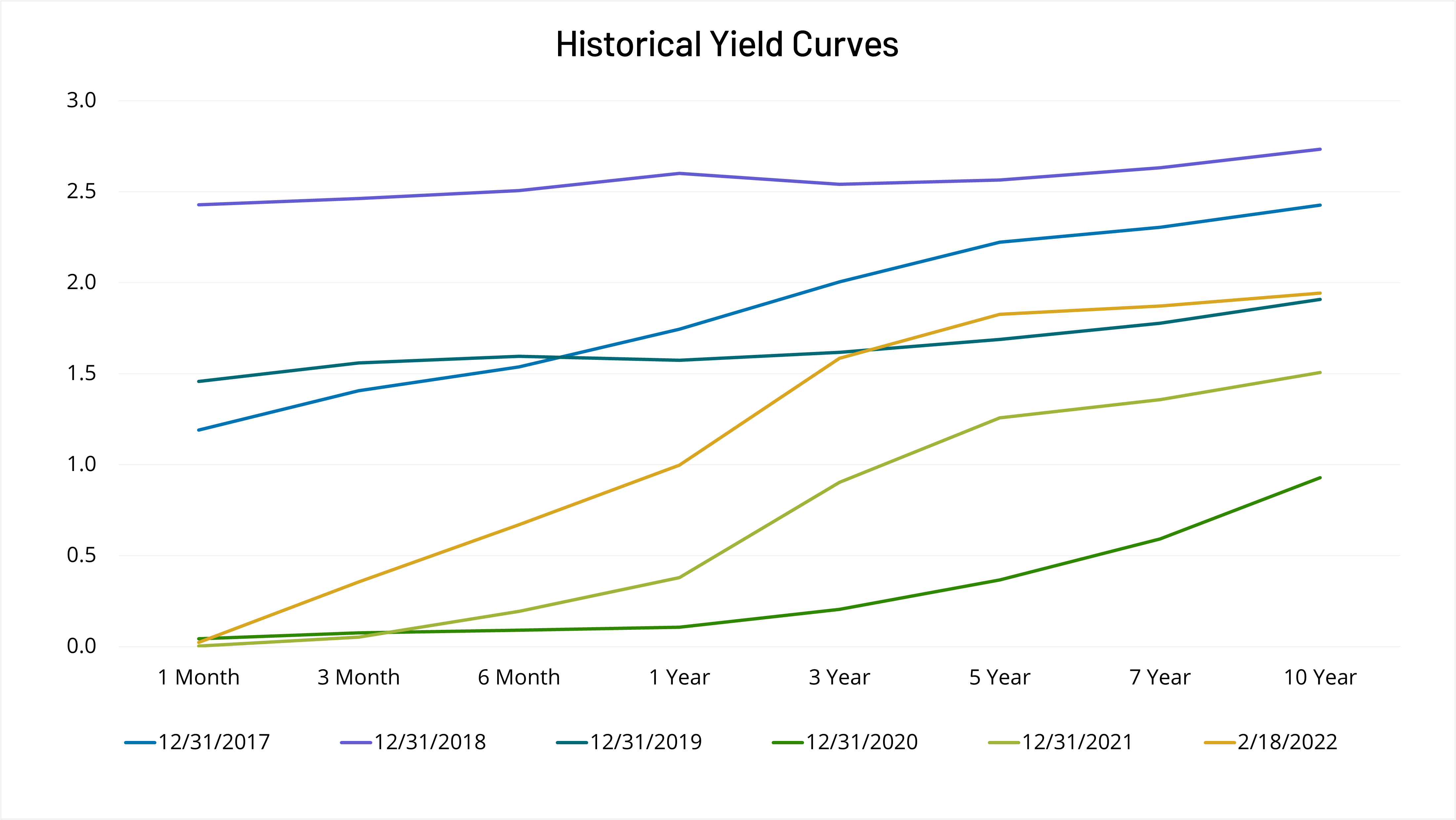

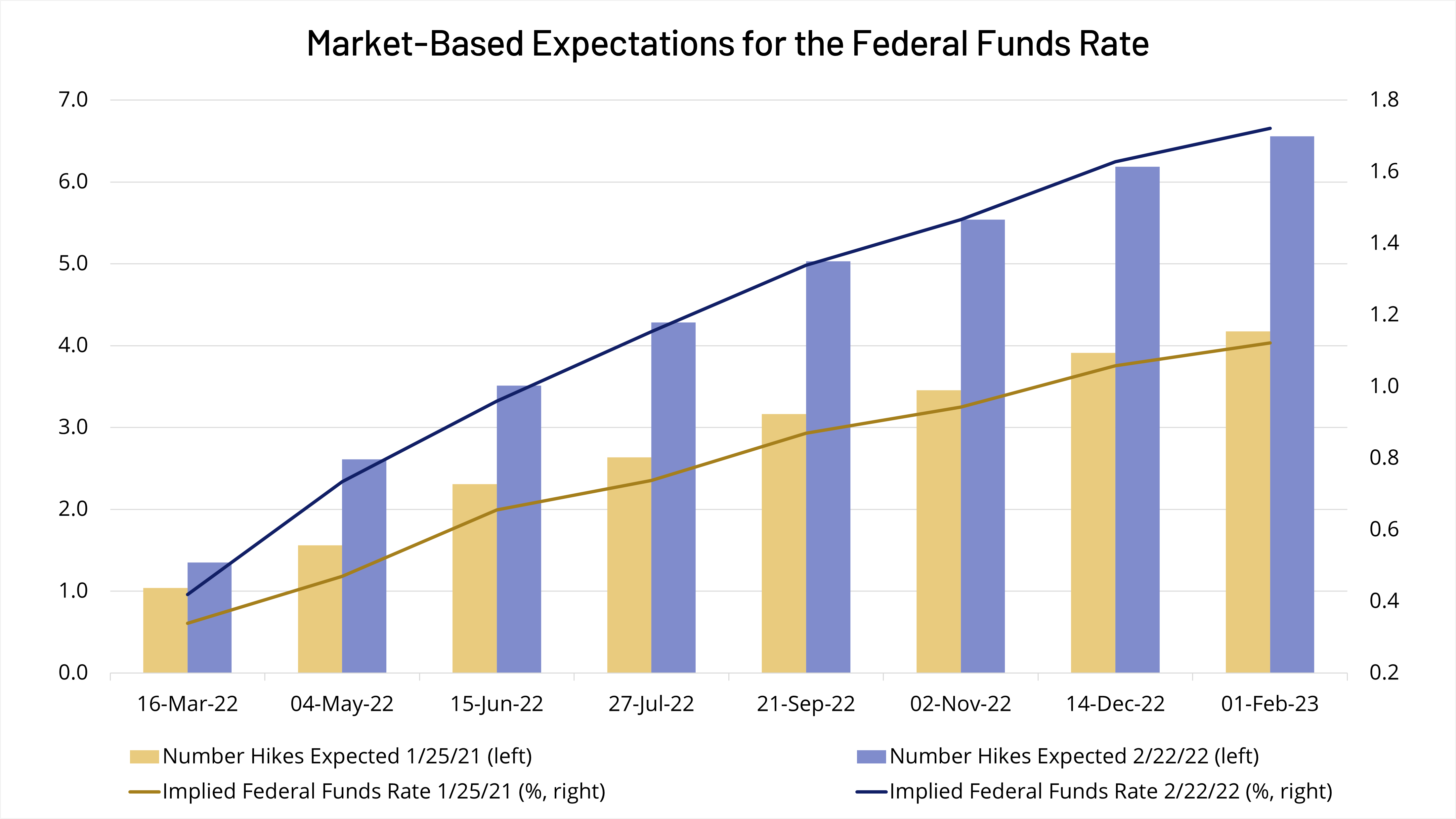

The Fed has also indicated that a series of short-term rate hikes is on the horizon, this year and beyond. Initially, the market was anticipating three 25-basis-point rate hikes in 2022. However, in the wake of the January 2022 employment and consumer price reports, traders and investors are now pricing in six increases by the end of this year (as illustrated in the following chart).

With an evolving interest-rate landscape, now may be the time to evaluate your liquidity mix and to consider adding a component of term advances funding to your liability structure in order to hedge interest rate risk and to capitalize on relatively low long-term rates we are still experiencing.

Thoughts for 2022

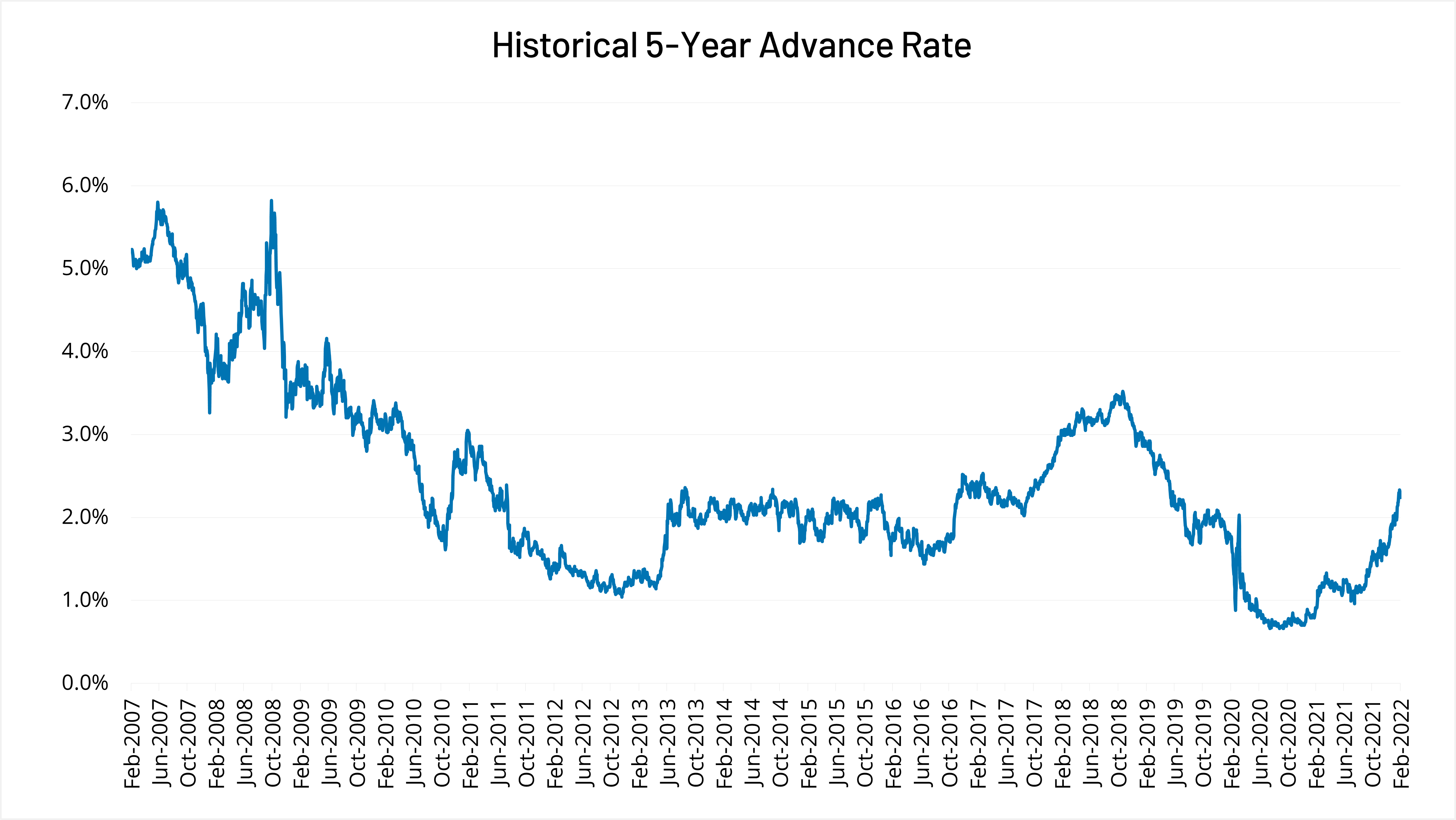

- Lock-In Spreads – Although we appear to have come off the bottom with regard to longer-term borrowing rates, you can still preserve spreads and borrow longer-term at historically low levels. The following chart illustrates the history of the benchmark 5-year Fixed-Rate Advance. Today’s term borrowing levels remain attractive over a 15-year horizon. Including a component of term liquidity in your funding mix at this time may make sense should your balance sheet require liability extension.

Additionally, with mortgage rates coming off a recent bottom and still close to historic lows, there is concern of heightened extension risk, with the possibility of homeowners staying in their homes for a prolonged period of time due to their low current mortgage payments. To mitigate this risk some members utilize our regular term advances and apply a “barbell” approach, using short-term advances to fund deposit shortfalls, while also using long-term advances to preserve spread and guard against mortgage pools extending beyond their expected average life. Members also often apply a laddering approach, layering in short-, medium- and long-term advances to optimize return and mitigate interest rate risk through the life of their long-term assets. Regular advances remain the most popular type of FHLBNY funding used to match fund long-term assets and address interest-rate sensitivity. - Invest in Technological Infrastructure – To compete for business with an evolving consumer base, members need to have the appropriate technological infrastructure with robust delivery systems. For smaller members lacking scale, the expense associated with offering these delivery systems can be daunting. However, to thrive and survive, the investment may be necessary.

The FHLBNY can help you with your technological journey by providing term financing for your respective initiatives. Members can choose an advance structure with a repayment plan that can amortize over time, or may elect to choose another structure where payments can coincide with a platform launch or when the platform starts to yield an adequate return on investment.Additionally, you may consider using your FHLBNY liquidity facility to leverage your capital so that you have the incremental earnings necessary to properly compete from a technological perspective. We will be happy to discuss leverage strategies with you and provide funding alternatives which can help you grow capital and boost bottom-line earnings.

- Optimize Deposit Pricing – Many of our members are in a borrowing position because they use FHLBNY advances as a tool to manage interest expenses on their deposits. When doing this, members will embark on pricing strategies designed to lower their cost of funds, sometimes causing an outflow of rate-sensitive deposits, while using FHLBNY advances to back-fill for resulting shortfalls. This strategy offers members flexibility and drives bottom-line earnings in a difficult operating environment. As someone famous once said, “If you’re not in a borrowing position, you are paying up for your last deposit dollar.”

We welcome the opportunity to discuss these and other strategies with you, your ALCO team, and Boards of Directors in further detail. Our Financial Economist, Brian Jones, is also available to present to your organization. Please call your Relationship Manager at 212-441-6700 to arrange a personalized meeting.

Disclaimer: Notwithstanding any language to the contrary, nothing contained in these disclosures is intended to constitute an offer, inducement, promise, or contract of any kind. Any product descriptions and pricing may be subject to change without notice.

The content provided in these disclosures is presented as a courtesy to be used only for informational purposes and is not represented to be error free. The FHLBNY makes no representations or warranties of any kind with respect to the content contained herein, such representations and warranties being expressly disclaimed. The FHLBNY is not a financial or investment advisor.

Moreover, the FHLBNY does not represent or warrant that the content of these disclosures is accurate, complete or current for any specific or particular purpose or application. It is not intended to provide nor should anyone consider that it provides legal, accounting, tax or other advice. Such advice should only be rendered in reference to the particular facts and circumstances appropriate to each situation. The FHLBNY encourages you to contact appropriate professional(s) and consultant(s) to assess your specific needs and circumstances and to render such advice accordingly. In addition, the FHLBNY is not endorsing or recommending the use of the means or methods contained in or through these disclosures for any special or particular purpose.

It is solely your responsibility to evaluate the risks or merits of any funding or investment strategy. In no event will FHLBNY or any of its officers, directors or employees be liable for any damages — whether direct, indirect, special, general, consequential, for alleged lost profits, or otherwise – that might result from any use of or reliance on these materials.